Published: October 2025

Monthly financial reporting shouldn't consume your entire week. Yet many Australian business owners and finance teams still wrestle with Excel spreadsheets, manual data entry, and disconnected systems when preparing their monthly reports. The rise of specialised Xero reporting integrations has transformed how businesses approach financial reporting, but with dozens of options available, choosing the right one can feel overwhelming.

After analysing feedback from over 50 Australian finance professionals, CFOs, and accounting firms, three reporting solutions consistently emerge as the top choices for small to medium enterprises: Syft Analytics, Fathom, and G-Accon. Each serves different business needs, budgets, and technical requirements.

This comprehensive analysis examines these three platforms through the lens of real Australian businesses, providing the insights you need to make an informed decision for your monthly reporting needs.

Australian businesses lose an average of 15-20 hours per month on manual financial reporting tasks. A recent survey of finance teams across Australia revealed that 73% still rely primarily on Excel for monthly reports, with 41% describing their current reporting process as "time-consuming and error-prone."

The traditional approach typically involves:

Modern Xero reporting integrations eliminate these manual processes, automatically pulling live data and generating professional reports in minutes rather than hours.

Syft Analytics positions itself as the premium reporting solution for businesses requiring sophisticated financial analysis and multi-entity consolidation capabilities.

Automated Consolidation:

Syft's consolidation engine handles multiple Xero organisations automatically. For businesses operating across different states or with subsidiary companies, this feature alone can save 10-15 hours per month. The system eliminates intercompany transactions and provides consolidated profit and loss statements, balance sheets, and cash flow reports.

AI-Powered Analytics:

The platform uses artificial intelligence to identify trends, anomalies, and insights within your financial data. For example, if your gross profit margin drops by 3% compared to the previous month, Syft will highlight this variance and suggest potential causes.

Professional Report Presentation:

Syft generates board-ready reports with your company branding. Australian businesses using Syft report that their monthly board meetings now focus on strategic discussions rather than explaining financial data, as the reports clearly present key metrics and trends.

Advanced KPI Tracking:

The platform tracks over 150 financial KPIs automatically, including industry-specific metrics. For retail businesses, this includes inventory turnover ratios and same-store sales growth. For professional services firms, it tracks utilisation rates and revenue per employee.

Syft operates on a tiered pricing model:

Fathom focuses on making financial data accessible through compelling visual presentations and user-friendly dashboards.

Visual Dashboard Design:

Fathom excels at presenting financial data through intuitive charts, graphs, and visual elements. The platform automatically selects appropriate visualisations based on your data type, creating reports that non-financial stakeholders can easily understand.

Comparative Analysis Tools:

The system enables easy period-over-period comparisons, budget variance analysis, and forecasting. Users can quickly identify trends by comparing performance across different time periods or against industry benchmarks.

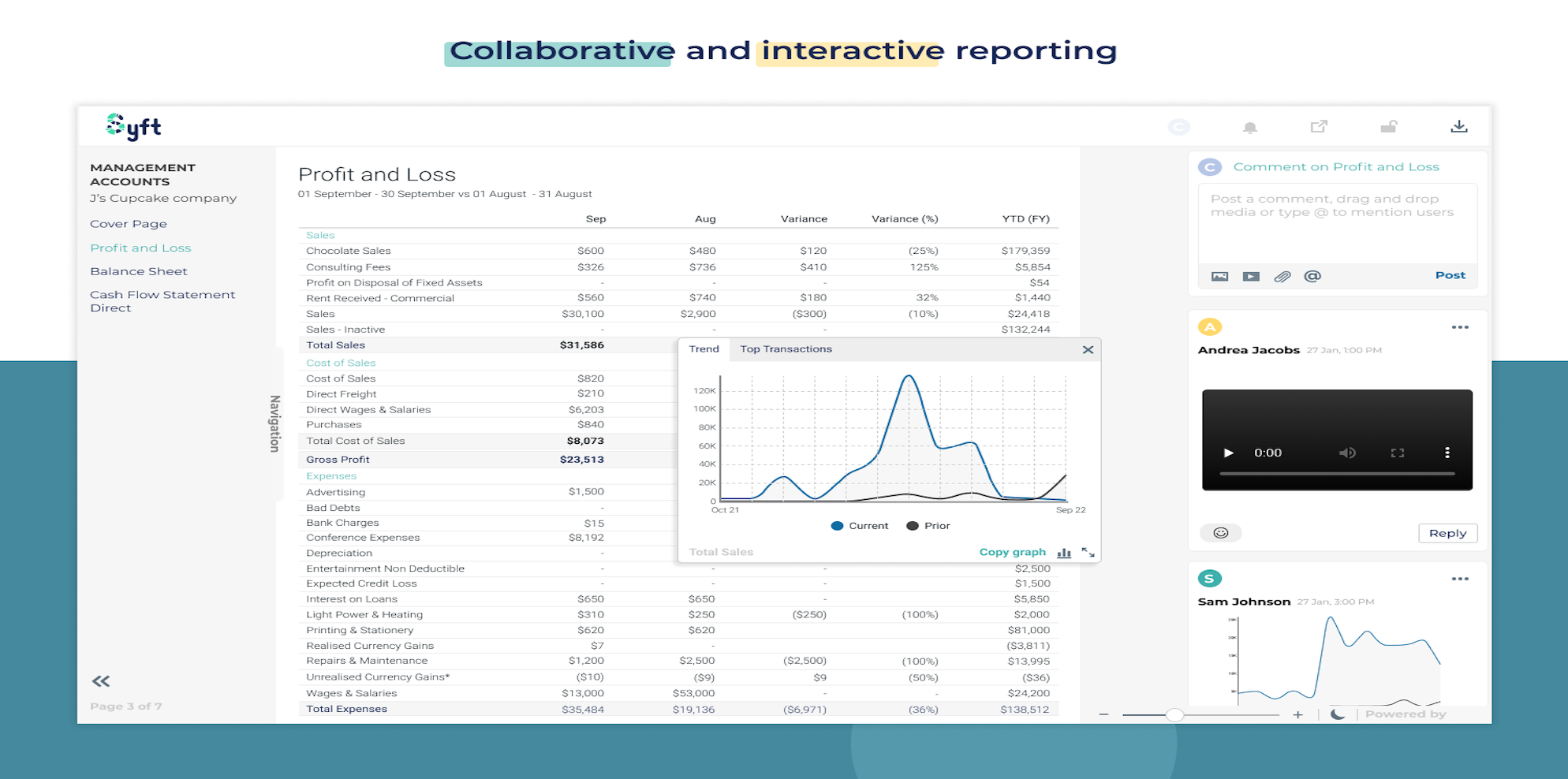

Collaborative Features:

Teams can comment on reports, share insights, and collaborate directly within the platform. This feature particularly benefits businesses where multiple departments contribute to monthly reporting discussions.

Forecasting Capabilities:

Fathom's forecasting tools allow businesses to create scenario-based projections. The platform can model different growth scenarios, helping businesses plan for various market conditions.

Based on current available information, Fathom uses a tiered pricing model:

G-Accon bridges the gap between Xero's data and the familiar Excel or Google Sheets environment, offering powerful integration capabilities for businesses preferring spreadsheet-based reporting.

Live Data Integration:

G-Accon creates direct connections between Xero and your existing spreadsheets. Data updates automatically, eliminating the need for manual exports and imports. Changes in Xero appear in your spreadsheets within minutes.

Multi-Source Data Combination:

Beyond Xero integration, G-Accon can pull data from other business systems, combining financial data with operational metrics, sales figures, or inventory information in a single report.

Automated Calculations and Processes:

The system can automate complex calculations, data validation, and even basic bookkeeping entries. For example, you can set up automated journal entries based on spreadsheet calculations.

G-Accon pricing is based on usage tiers:

Important Pricing Note: All pricing mentioned in this article is approximate and based on available public information. Software pricing changes frequently, and many providers offer regional pricing variations, discounts, or promotional rates. Always contact providers directly for current Australian pricing before making purchasing decisions.

Syft Analytics: Typically requires 2-3 days for full implementation. The complexity comes from mapping multiple entities and configuring consolidation rules. However, once configured, the system requires minimal ongoing maintenance.

Fathom: Usually operational within 4-6 hours. The straightforward setup process involves connecting Xero accounts and selecting report templates. Most businesses can begin generating reports on the same day as implementation.

G-Accon: Implementation time varies significantly based on existing spreadsheet complexity. Simple integrations take 1-2 hours, while comprehensive custom reporting systems may require 1-2 weeks of development time.

Syft Analytics: Requires moderate training investment. Finance teams typically need 2-3 training sessions to fully utilise advanced features. Non-financial users can interpret reports immediately due to clear presentation.

Fathom: Minimal learning curve. Most users become proficient within 1-2 hours. The intuitive interface mirrors familiar business intelligence tools.

G-Accon: Learning requirements depend on existing spreadsheet skills. Teams comfortable with advanced Excel functions adapt quickly, while basic users may need additional training on formula creation and data manipulation.

Syft Analytics: Scales effectively with business growth. Adding new entities, currencies, or reporting requirements integrates seamlessly. The platform handles businesses from $1 million to $100 million+ in revenue without performance degradation.

Fathom: Accommodates growth well within single-entity businesses. Multi-entity capabilities exist but are less sophisticated than Syft's consolidation features. Best suited for businesses under $50 million in revenue.

G-Accon: Scalability depends on spreadsheet design and complexity. Well-designed systems can handle significant growth, while poorly structured spreadsheets may require rebuilding as businesses expand.

Syft Analytics: Integrates with major business systems beyond Xero, including MYOB, QuickBooks, and various CRM platforms. API connections enable custom integrations with industry-specific software.

Fathom: Primarily focused on accounting system integrations. Strong connections with Xero, QuickBooks, and MYOB, but limited third-party system integration capabilities.

G-Accon: Offers the most flexible integration options through its spreadsheet-based approach. Can connect virtually any system that exports data to Excel or provides API access.

For a typical Australian business with $5-10 million annual revenue:

Time Savings Value

Improved Decision MakingAccess to timely, accurate financial data enables faster business decisions. Australian businesses using automated reporting tools report average revenue improvements of 8-12% due to better-informed strategic choices.

Compliance and Accuracy BenefitsAutomated systems reduce human error by approximately 85%. For businesses previously experiencing monthly reporting corrections, this represents significant cost savings in both time and potential compliance issues.

Syft Analytics Professional Plan

Fathom Multiple Companies Plan

G-Accon Professional Plan

Note: Software costs are based on mid-range pricing estimates. Contact providers directly for current Australian pricing.

Choose Syft Analytics if:

Choose Fathom if:

Choose G-Accon if:

- Professional Services Firms: Fathom's visual presentation and collaborative features align well with client-facing requirements and team-based decision making.

- Manufacturing and Distribution: Syft's multi-entity consolidation and advanced analytics suit complex operational structures and inventory-heavy business models.

- Retail and Hospitality: G-Accon's flexibility enables integration of point-of-sale data, inventory systems, and financial reporting for comprehensive performance analysis.

- Construction and Project-Based Businesses: Syft's project tracking and consolidation features provide visibility across multiple job sites and entities.

Data Quality Assessment: Before implementing any reporting solution, conduct a comprehensive review of your Xero data quality. Inconsistent chart of accounts structures, incomplete transaction coding, or missing bank reconciliations will impact reporting accuracy regardless of the chosen platform.

Stakeholder Requirements Gathering: Document specific reporting requirements from all stakeholders. Understanding who needs what information, in what format, and how frequently will guide both platform selection and configuration decisions.

Change Management Planning: Moving from manual to automated reporting represents a significant workflow change. Develop a change management plan including training schedules, parallel reporting periods, and success metrics.

Regular Review and Refinement: Schedule monthly reviews of report effectiveness and accuracy. Most platforms allow ongoing customisation and improvement based on user feedback and changing business requirements.

User Training and Support: Invest in comprehensive user training beyond initial implementation. Advanced features often provide the greatest value but require deeper understanding to utilise effectively.

Performance Monitoring: Track time savings, error reduction, and decision-making improvements to quantify the return on investment and identify areas for further optimisation.

All three platforms continue investing in AI-powered features. Syft leads in predictive analytics, while Fathom focuses on automated insight generation. G-Accon's AI development targets intelligent data mapping and formula suggestions.

Mobile reporting access becomes increasingly important for Australian businesses with remote teams or field-based operations. Current mobile capabilities vary significantly between platforms, with Fathom offering the most comprehensive mobile experience.

The trend toward unified business platforms suggests future consolidation of reporting, CRM, and operational systems. Consider how your chosen reporting solution fits within your broader technology ecosystem and future integration requirements.

Fathom typically takes 4-6 hours to implement, G-Accon ranges from 1-2 hours for simple setups to 1-2 weeks for complex integrations, while Syft Analytics usually requires 2-3 days for full implementation including multi-entity consolidation setup.

Yes, all three solutions accommodate Australian GST requirements and can generate tax-compliant reports. Syft and Fathom include built-in Australian tax report templates, while G-Accon enables custom GST reporting through spreadsheet integration.

All platforms provide data export capabilities. Syft and Fathom maintain data within their systems, while G-Accon primarily works with your existing spreadsheets, making data portability simpler.

Syft and Fathom integrate with multiple accounting platforms including MYOB and QuickBooks. G-Accon offers the most flexibility, connecting to virtually any system that exports to Excel or provides API access.

Syft provides comprehensive multi-currency consolidation and reporting. Fathom offers basic multi-currency support suitable for most SMEs. G-Accon handles multi-currency through spreadsheet formulas and can be customised for complex currency requirements.

Fathom requires minimal technical knowledge for ongoing maintenance. Syft needs moderate technical understanding for advanced features. G-Accon requirements vary based on spreadsheet complexity but generally need strong Excel skills for custom development.

All three platforms offer free trials: Syft provides a 14-day trial, Fathom offers 30 days, and G-Accon includes a 14-day trial period. Take advantage of trial periods to test functionality with your actual Xero data.

All platforms maintain Australian data residency options and comply with privacy regulations. Syft and Fathom use enterprise-grade encryption and security protocols, while G-Accon security depends on your chosen spreadsheet platform (Microsoft 365 or Google Workspace).

Scale Suite provides comprehensive finance and HR solutions for Australian businesses, specialising in Xero implementation, monthly reporting optimisation, and fractional CFO services. Our team helps businesses with reporting needs while ensuring data accuracy and meaningful financial insights.

Our reporting services include monthly management report preparation, KPI dashboard development, and cash flow forecasting. We work with businesses across Australia to streamline their financial reporting processes and improve decision-making capabilities through better data analysis and presentation.

Scale Suite delivers embedded finance and human resource services for ambitious Australian businesses.Our Sydney-based team integrates with your daily operations through a shared platform, working like part of your internal staff but with senior-level expertise. From complete bookkeeping to strategic CFO insights, we deliver better outcomes than a single hire - without the recruitment risk, training time, or full-time salary commitment.

Considering building an internal finance team?

We'll show you exactly what our three-tier model covers, how it compares to internal hires, and what it would cost for your business.

We'll reply within 24 hours to book your free 30-minute call.

No lock-in contracts and 30-day money-back guarantee.

Prefer to book directly? Schedule your free 30-minute call here