Published: October 2025

As an employer in Australia, managing payroll involves various withholdings, including Study and Training Support Loans (STSL) tax. This ensures employees with government study debts repay them once their income reaches certain levels. Staying compliant helps avoid penalties and supports smooth operations.

STSL tax refers to compulsory repayments withheld from an employee's pay for government-funded study and training loans. It is income-contingent, meaning repayments start only when earnings exceed a threshold. Employers calculate and withhold these amounts alongside Pay As You Go (PAYG) tax. Loans covered include Higher Education Loan Programme (HELP, formerly HECS), VET Student Loans (VSL), Student Start-up Loans (SSL), and Trade Support Loans (TSL).

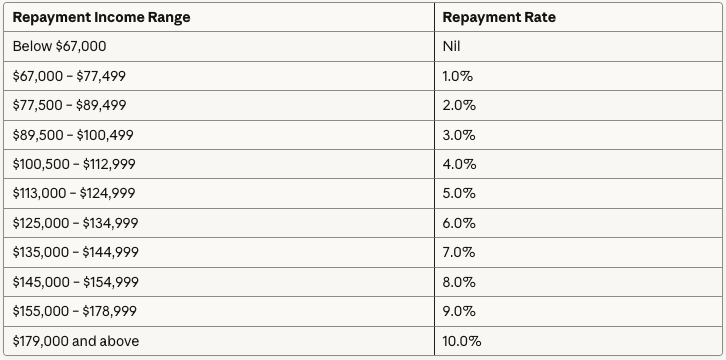

Employees with outstanding STSL debts must repay if their annual income surpasses the minimum repayment threshold. For the 2025-26 income year, this threshold is $67,000. Employers withhold based on employee declarations via the Tax File Number (TFN) form. Part-time or casual workers are included if their total income qualifies. Non-residents or those without debts are exempt.

Also check out our useful tools for SMEs found here.

The process integrates with payroll:

Voluntary repayments can be made separately, but compulsory ones are handled through payroll.

Rates are progressive and apply to income above the threshold. For 2025-26:

To calculate: Estimate annual income, apply the rate to the entire repayment income (not just the excess), and divide by pay periods. Use ATO schedules for weekly, fortnightly, or monthly withholdings. For example, for weekly pay over $1,288 (with tax-free threshold), consult the STSL weekly tax table.

HECS was the original scheme for higher education fees, evolving into HELP in 2005 with broader loan types. STSL is the payroll term encompassing HELP and other loans like VSL and TSL. In practice, for withholding, STSL and HECS-HELP are interchangeable.

Compliance is key - refer to the ATO for the latest details to ensure accuracy. Also use our interactive ATO compliance tool here.

What is STSL tax in Australia?

STSL tax is the compulsory repayment withheld from employees' pay for government study loans like HELP, VSL, and TSL when income exceeds the annual threshold.

Who needs to withhold STSL tax as an employer?

Employers must withhold STSL for employees who declare a study loan debt on their TFN form and whose projected income is above $67,000 for 2025-26.

How do I calculate STSL tax repayments?

Estimate the employee's annual repayment income, apply the progressive rate (1% to 10%) from ATO tables, and divide by pay frequency for withholding amounts.

What is the STSL repayment threshold for 2025-26?

The minimum repayment threshold is $67,000. No repayments are required below this amount, with rates increasing progressively above it.

Is STSL the same as HECS or HELP?

STSL encompasses HELP (which replaced HECS) and other loans like VSL and TSL for payroll withholding purposes.

What happens if an employee's income changes during the year?

Withhold based on projections; the ATO adjusts final amounts at tax time, issuing refunds or additional bills as needed.

Scale Suite delivers embedded finance and human resource services for ambitious Australian businesses.Our Sydney-based team integrates with your daily operations through a shared platform, working like part of your internal staff but with senior-level expertise. From complete bookkeeping to strategic CFO insights, we deliver better outcomes than a single hire - without the recruitment risk, training time, or full-time salary commitment.

Considering building an internal finance team?

We'll show you exactly what our three-tier model covers, how it compares to internal hires, and what it would cost for your business.

We'll reply within 24 hours to book your free 30-minute call.

No lock-in contracts and 30-day money-back guarantee.

Prefer to book directly? Schedule your free 30-minute call here